Investment Planning - Think Globally

- rileygpoppy

- Mar 1, 2021

- 3 min read

With US stocks outperforming non-US stocks in recent years, some investors might be questioning the benefits of investing in international markets. While there are many reasons why a US-based investor may have a degree of home bias in their portfolios, using return differences as the primary decision-driver may result in missed opportunities. With international markets delivering disappointing returns relative to the US over the last few years, it is important to remember that:

Non-US stocks help provide valuable diversification benefits.

Recent performance is not a reliable indicator of future returns.

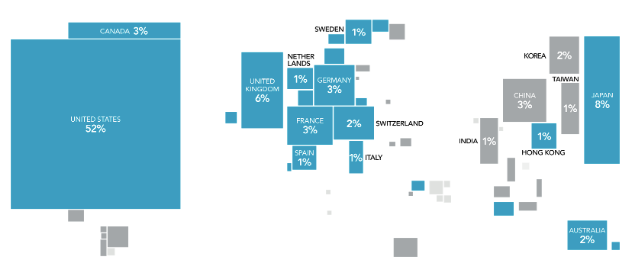

There's a World of Opportunity in Equities

The global equity market is large. As shown below, nearly half of the investment opportunities in global equity markets lie outside the US. Non-US stocks, including developed and emerging markets, account for 48% of world market capitalization and represent thousands of companies in countries all over the world. A portfolio invested solely within the US would not be exposed to the performance of those markets.

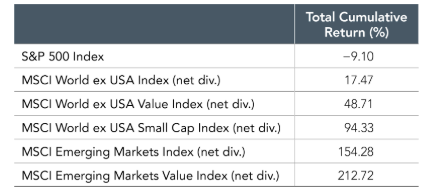

The Lost Decade

We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000–2009. During this period, often called the “lost decade”, the S&P 500 Index recorded its worst ever 10-year performance with a total cumulative return of –9.1%. However, most equity asset classes outside the US generated positive returns over the course of the decade. Expanding beyond this period and looking at performance for each of the 11 decades starting in 1900 and ending in 2010, the US market outperformed the world market in just five decades and underperformed in the other six. By holding a globally diversified portfolio, investors are positioned to capture returns wherever they occur.

Pick a Country?

Is there a proven strategy to identify the winners and loser in advance? The chart below shows the randomness in country equity returns rankings (from highest to lowest) over the past 20 years. Executing a strategy that relies on consistently picking the best country year-to-year is impossible. And concentrating a portfolio in any one country can expose investors to large variations in returns. The difference between the best and worst performing countries can be significant. For example, since 1998, the average return of the best-performing developed market country was approximately 44%, while the average return of the worst-performing country was approximately –16%. Diversification means an investor’s portfolio is unlikely to be the best or worst performing relative to any individual country. This provides a more consistent outcome and more importantly helps reduce and manage catastrophic losses that can be associated with investing in just a small number of stocks or a single country.

Interestingly enough, Denmark was the best performer among all developed markets with an annualized return of 9.1%. However, Denmark had the best calendar year return only once, in 2015. The US, despite some strong returns in the last several years, placed ninth overall with an annualized return of 4.9%. Bear in mind, Denmark represents less than 1% of the global market cap available to investors.

The Bottom Line

Over long periods of time, investors benefit from consistent exposure in their portfolios to both US and non-US equities. While both asset classes offer the potential to earn positive expected returns in the long run, they may perform quite differently over short periods. While the performance of different countries and asset classes will vary over time, there is no reliable evidence that this performance can be predicted in advance. An optimal approach to equity investing takes advantage of the entire global markets.

If you need assistance designing a global portfolio or overall financial planning advice, schedule a free consultation today with a Certified Financial Planner in Seattle.

Data, Charts, and Graphs provided by Dimensional Fund Advisors (DFA).

*All written content on this site is for information purposes only. Opinions expressed herein are solely those of Ignite Financial Planning, LLC, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. This website may provide links to others for the convenience of our users. Our firm has no control over the accuracy or content of these other websites.

Comments