My Company's Stock is Killing it. Why Diversify?

- rileygpoppy

- Mar 1, 2021

- 4 min read

Times are good for many companies, especially for some large tech companies. Stock prices seem to be going up consistently and a few companies have even crept close to trillion dollar valuations. For employees, a large percentage of your benefits and your compensation may be tied to the performance of the stock. When times are good, why seek diversification; why change? Can a diversified portfolio really outperform my company’s stock? In this week’s post, we are going to discuss 3 reasons why you should consider diversifying.

Investment Science 101

To understand the value of diversification, let’s dig into a few investment principles. All investments come down to risk and return. In portfolio management, a manager seeks to find the highest return per amount of risk. This is called risk-adjusted returns. Risk is composed of two parts, systematic and unsystematic. Systematic risk is exposure to the overall economy. It is impossible to completely remove. Unsystematic risk, also known as isolated or company-specific risk can be removed. Because individuals stocks carry unsystematic risk, they are risk-inefficient and thus create a risk drag on a portfolio. The effects of unsystematic risk can be devastating for investors. Recent examples include the dot com bust in 2000 and the Global Financial Crisis in 2008. While these events adversely affected diversified portfolios for a short period of time, several individual companies went bankrupt, took years to recover, or never recovered at all. Diversification cannot reduce the volatility of the overall market, but it reduces the risk associated with individual firms.

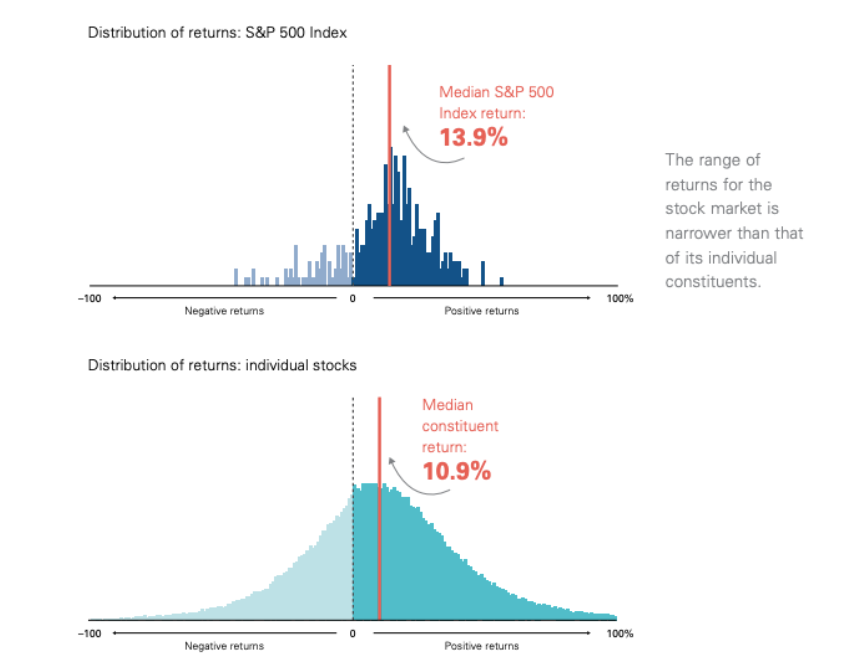

Another goal of portfolio management is to reduce the range of possible returns. A reduced range of returns, makes planning for investment-related goals simpler. As shown below, from Vanguard’s research, the range of company-specific returns is much larger than compared to the S&P 500 Index, with many more years of negative returns. For example, when you own an individual stock you are receiving high risk for a potentially high reward. Meanwhile, with a diversified mutual fund you are receiving a potentially high reward with a lower amount of risk.

Distributions

Eventually, you may need to take large distributions from your investment portfolio. This could be for a future goal like a home down payment or for retirement. Taking distributions from a concentrated position can be limiting. While certainly possible, it requires more leg work and the timing becomes more difficult. For example, choosing what share-lots to sell, harvesting capital gains and losses can be cumbersome. Generally, it is best to take distributions from whichever asset class is up at the particular moment in time. If a company's stock position is a large percentage of your portfolio, you’ve effectively handicapped yourself. You run the risk of having your distributions directly affected by unsystematic risk. What if you need to take a distribution and that stock is performing poorly? A mix of asset classes with varying correlation gives you options and flexibility. If your entire portfolio is up or down at the same time, then you are not diversified.

Familiarity Bias

As an employee, you may feel like you have an inside look into how your company operates. And the familiarity of your company often creates comfort. This investment strategy implies a double risk as both your wages and your savings are controlled by the success of your company. However, be aware of all the risks that could adversely affect your company e.g. CEO changes, new regulation, environmental change, changing consumer tastes, layoffs, etc. Having a time perspective can help remove this bias. According to CNBC and Credit Suisse, the average lifespan of an S&P 500 company is under 20 years, down from 60 years in the 1950s. With a diversified mutual fund, new companies are automatically added over time thus eliminating company-specific risk. Said another way, very few individual companies will exceed your long-term investment time horizon.

Well, you might be saying, “Wait, my company is different.” Even Jeff Bezos, the CEO of Amazon, stated, “Amazon is not too big to fail...in fact, I predict one day Amazon will fail. Amazon will go bankrupt. If you look at large companies, their lifespans tend to be 30-plus years, not a hundred-plus years.”

The Bottom Line

We have no control over the stock market’s performance and picking winners and losers is a losing proposition. Financial planning is about focusing on the items within our control. And yes, company pride is important, but don’t let in factor into your overall financial plan. As financial author, Kaye A. Thomas said, "The knowledge you gain about your company by going to work there every day doesn't help you predict how the stock is going to perform. The stock can go down when your company seems to be doing great, and it can go up when it seems to be in a rut. Your inside information is more likely to hurt than help, blind you to realities that are apparent to objective observers."

Need personal guidance from a CFP® Professional on designing your investment portfolio and financial plan, schedule a free consultation today!

*All written content on this site is for information purposes only. Opinions expressed herein are solely those of Ignite Financial Planning, LLC, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. This website may provide links to others for the convenience of our users. Our firm has no control over the accuracy or content of these other websites.

Comments